Over the years, I've grown a great interest in stock markets. I love the psychology behind them, I love the technical charting side and I love the patterns. In light of what's going on in the world at the moment, people are uncertain about the future and rightfully so. Questions like, "Am I going to lose all my money?", "Should I close my business" and others are and have been floating around the past month or so. In this post, I want to try and share how I position my mind to get through this, and hopefully help some of you to look at it like I do. I also want to attempt to show a similarity between digital marketing and the stock markets.

Disclaimer 1: I appreciate that this isn't for everyone, there are parts in this that don't speak to those who have lost family members or friends, nor does it address those who have lost their jobs. Unfortunately, I cannot cover every single angle so I'm doing my best to address perhaps one segment and uplift that segment.

Disclaimer 2: I'm not an economist nor a licensed financial advisor, this most is merely some of my thoughts on how I position my mind.

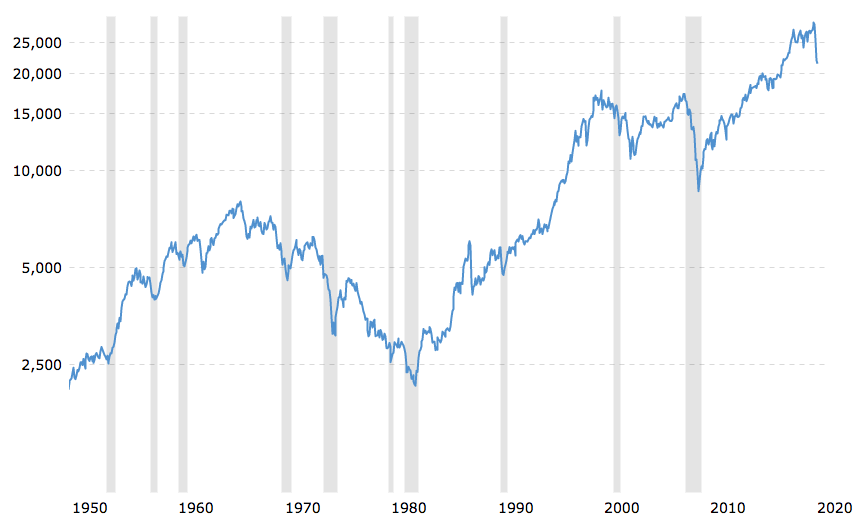

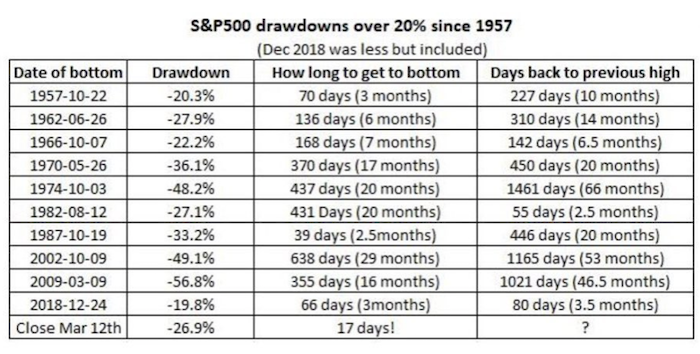

I'm a graph guy, I love graphs so it's appropriate that I start with a nice graph:

Let's interpret this quickly:

- This is the Dow Jones over the past 70 years. The Dow Jones is an index that tracks 30 large, publicly-owned blue-chip companies trading on the New York Stock Exchange (NYSE) and the NASDAQ.

- The graph is inflation-adjusted using the headline CPI (consumer price index) and each data point represents the month-end closing value.

Q: I'm not a financial guy, what on earth are you talking about?

A: Thank you for asking. Basically, this graph gives us an idea of the economy over the past 70 years, to a degree.

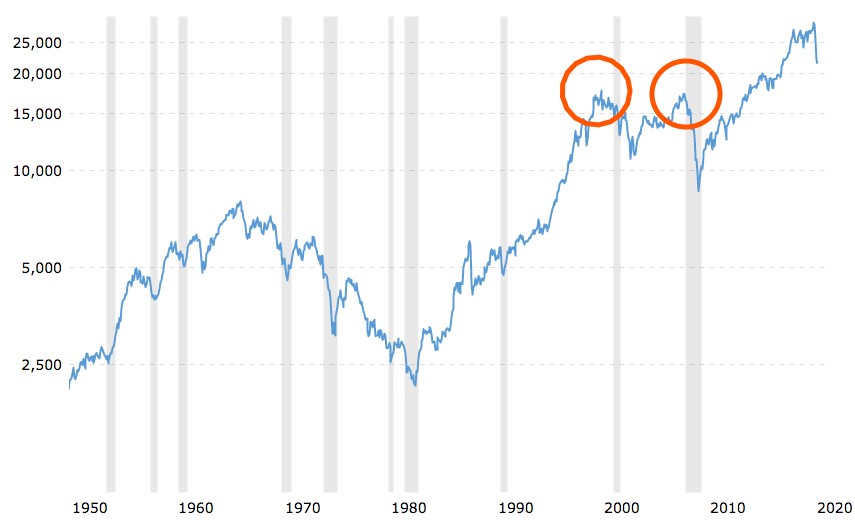

There are two specific events I want to address in this graph:

- The Dot Com burst in 2000

- The Real Estate crash in 2008

Both of these events can be seen here:

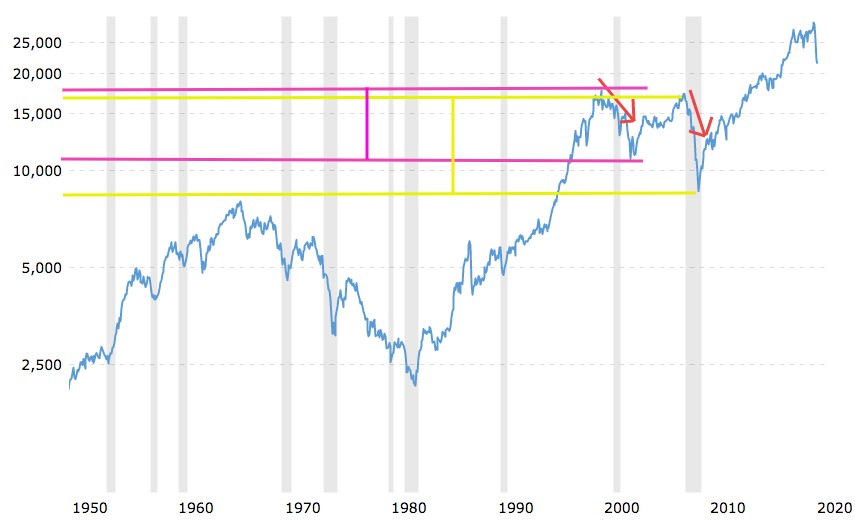

Both of these enormous events resulted in the stock market dropping considerably:

Let's look at the chart again, noting down the effects:

- The pink lines show us just how much the stock market dropped when the Dot Com bubble burst - that's a big drop.

- The yellow lines show us just how much the stock market dropped when the Real Estate crash happened - another massive drop.

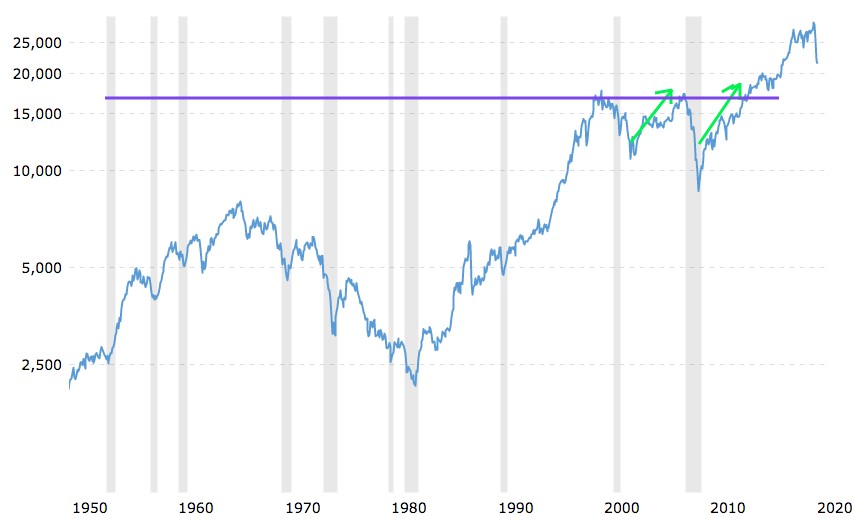

These were incredibly worrying times, interest rate issues, debt problems and a long list of scary life-affecting actions took place. But, let's look at the graph again like this:

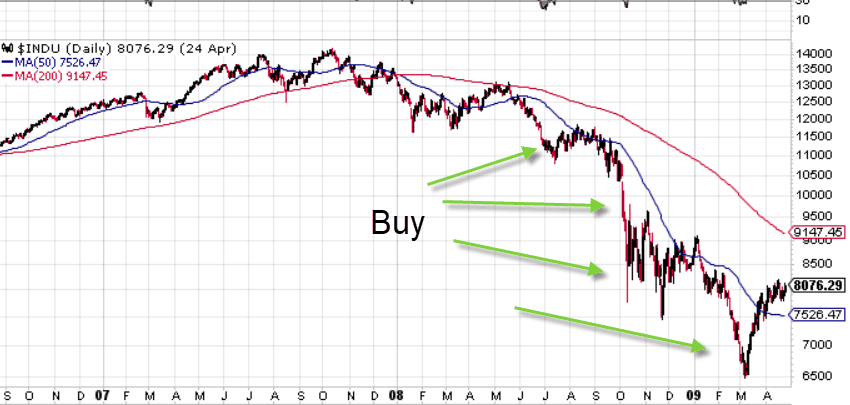

Right, now we've moved away from all the negativity around the burst and crash into recovery thinking. In both instances, after a crash, the market did recover! This is incredibly important to recognise - what comes down, does go back up again and visa versa, that's just how the world works. A blog on Immediate Code says that the complicated part is trying to guess how low a crash would go or how high the recovery will go, unfortunately, my crystal ball is lost. What we can see, though, is that it took 7 years for the Dot Com bust to recover and it took 5 years for the Real Estate crash to recover.

Note: This is different from individual companies, which can crash and never recover, but the market at large goes up and down and up and down and up and down.

When the market crashes, there are two ways to look at it:

- Panic

- Opportunity

Enter: Warren Buffet

Warren, one of the greatest value investors in the world (CEO of Berkshire Hathaway) said, “Be fearful when others are greedy and greedy when others are fearful.” This quote speaks exactly to the two points above, you can panic and be the fearful one when you're meant to be greedy, or you can see opportunity and be greedy when others are fearful.

What does this mean? It means that there's a massive opportunity right now as all those in fear are selling their shares at lower prices and you can be right there to scoop them up at cheaper prices - all whilst knowing that it might take time but the stock market will recover just like it always has done.

Warren Buffet is sitting on $128 billion in cash and has been for an extended amount of time, waiting for this moment where he can buy millions of stocks at reduced prices whilst everyone panics only to then sit back and wait for the market to recover over the years to come.

Another old adage that I love is, “it’s not about timing the market, but about time in the market,” - This is a bit more complicated considering what was said about Warren above. On one hand, the context speaks to waiting and timing the market, whereas the other says don't time - because we don't have a crystal ball. My take on this is that there's a combination: always be in the market, always be buying but be ready to buy more when the opportunity presents itself.

Okay, but ...

This is a marketing agency, what's this all about?

There are several reasons why I fell in love with investing and trading:

- Through iMod Digital, I've worked with businesses large (Google, Samsung, Foschini Group, etc.) and small, near and far. This has given me a great idea of how these businesses operate.

- Being a technical marketer, I work with charts and statistics every day of my life.

- I love business and I love seeing the influence of business on the stock exchanges.

There are many others, but those three come to mind. Understanding trading, investing and the economy has taught me a huge amount about the economy and business in general. This education can then be retrofitted into our marketing processes for the companies we work with and position us to achieve better results. I believe that just knowing how to market isn't enough, the truly successful marketers are those who intimately understand how businesses and the economy work.

Applying this knowledge and insight into the business, we're faced with the same two options:

- Panic

- Opportunity

And let's look at that saying again, “Be fearful when others are greedy and greedy when others are fearful.”

Same same but different. The markets (competitors) are lower which presents massive opportunity to double-down and invest in your business and marketing whilst so many others aren't. The reasons for the other businesses not investing in their businesses isn't important (we have to be cold like that), what's important is that they aren't and that presents us with a massive gap / opportunity to capture market share. The market will come back, people will be shopping again, people will be getting tattoos, jumping off bridges, going on holidays and all of the usual, it's merely a matter of time.

Ask yourself this, "Do you want to capture market share and be ready for all those people, or wait until then to start marketing again?" I know what my answer is!

It's easy to say so, acting is harder so here's what we've done:

- Increased our pay per click spend.

- Increased our content production.

- Increased our investments.

What's that doing to the business, though?

- It's drawing on some of our financial reserves,

- It's costing us a lot with little immediate return,

But that's okay because we'll be ready and waiting for when the markets open up again, our arms wide open and we'll be smiling at the top of the hill, ahead of the curve. A front foot forward essentially and I have absolutely no doubt about this.

Running an agency that offers various services such as pay per click marketing, search engine optimisation, social media marketing and so forth, I will quickly comment on each of these with my opinion on what one should be doing:

- Pay Per Click Marketing - Reduce your spend a bit and change your campaign requirements to increase awareness, draw people to landing pages with insights and specials, and get your remarketing intelligence going.

- Search Engine Optimisation - We all know this is a marathon and not a sprint, double-down on this and be at your peak when the market turns. No brainer.

- Social Media Marketing - Invest time into your social media channels, grow your network of followers and warm them up for market return.

- Content Marketing - Now is the time to seriously invest in content writing. If you're not as busy, pick up a pen or keyboard and get writing! Your content is your asset, grow it in conjunction with your SEO so that it's ready for the market correction.

- Web Design & Development - What a perfect time to invest into your website and web assets, get them performing as best as they can, upgrade them and spend time reviewing your content, tracking and the likes.

The list goes on!

Final Thoughts

I still believe the market is going to drop further whilst the world figures out Covid-19. I don't think we're near the bottom of the market yet, either. There's a strategy known as averaging down and this is where you invest at even frequencies as the market goes down. This is to avoid trying to time the market but rather invest at a fixed interval as you buy down the trend and thus average. This is the very method we want to be using for our marketing, keep investing but not all at once, spread it out over time as the market goes down.

Note: This is a random graph merely to show what Averaging Down is.

Running a business is complicated, being a marketing manager at a business is difficult, being in any position that makes decisions around things like marketing is really difficult right now. This could honestly be your moment to shine by being brave. Don't spend the next several years looking back and wondering what if or regretting not muscling down!

On a personal note:

Yes, this is scary, we're facing another huge change in the world and it's far worse than a Dot Com bubble burst or Real Estate crash because people are dying, everywhere. Any crash is scary but it's far worse when people are losing their lives, this on top of the crash makes it even harder to be brave. I am doubling down on everything where ever possible because I truly believe we'll get through this and although it might take some time, we will recover and I want to be at the end of the tunnel feeling proud that I believed in the world and myself. Bless you all during this difficult time - I've said it before, God does his greatest miracles in the largest messes.

Don't be fearful when others are afraid, now is the time to double-down and capture that market share - take your business ahead.